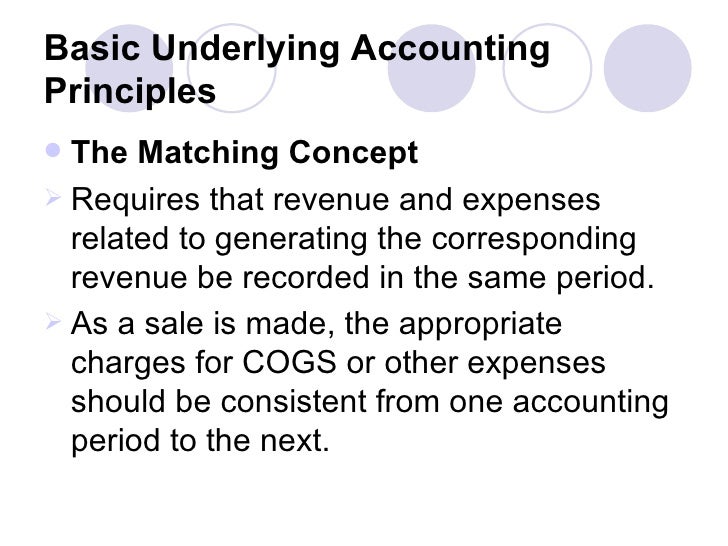

The second way to calculate the cost of goods sold is to use the following costs: beginning inventory + the cost of goods purchased or manufactured = cost of goods available – ending inventory. If 1,000 units were purchased but the inventory decreased by 100 units then the cost of 1,100 units will be the cost of goods sold. For example, if 1,000 units were purchased or manufactured but inventory increased by 100 units then the cost of 900 units will be the cost of goods sold. One way is to adjust the cost of the goods purchased or manufactured by the change in inventory of finished goods. Cost of goods sold is calculated in one of two ways. The sales revenues minus the cost of goods sold is gross profit. By matching the cost of the goods sold with the revenues from the goods sold, the matching principle of accounting is achieved. The cost of goods sold is reported on the income statement and can be considered as an expense of the accounting period. The cost of goods sold is the cost of the merchandise that a retailer, distributor, or manufacturer has sold. Because of the historical cost principle and other accounting principles the total amount reported in the capital accounts will not indicate the company’s market value or net worth. The total of the balances in the capital accounts must be equal to the reported total of the company’s assets minus its liabilities. At the end of each accounting year, Amy’s drawing account is closed by trferring its debit balance to the account Amy Fox, Capital. This account is a contra account because it will have a debit balance equal to the amount of business assets that Amy has withdrawn during the current accounting year for her personal use. This account begins with Amy’s original investment and is increased for each year’s earnings minus each year’s withdrawals by Amy. In a sole proprietorship (such as one owned by Amy Fox) the capital accounts include:Amy Fox, Capital. Retained earnings accounts which typically contain the amount of the corporation’s cumulative earnings since the corporation was formed minus the cumulative dividends distributed to the stockholders.Treasury stock account (a contra account because it has a debit balance) usually reporting the amount paid by the corporation to repurchase its own shares of stock that have not been retired. These accounts report the amounts received by the corporation when the shares of its capital stock were originally issued to investors. In a corporation the capital accounts include: Paid-in capital accounts such as Common Stock, Preferred Stock, Paid-in Capital in Excess of Par.

The balances of the capital accounts are reported in the owner’s equity, partners’ equity, or stockholders’ equity section of the balance sheet. In accounting and bookkeeping, a capital account is one of the general ledger accounts used to record 1) the amounts that were paid in to the company by an investor, and 2) the cumulative amount of the company’s earnings minus the cumulative distributions to the owners.

0 kommentar(er)

0 kommentar(er)